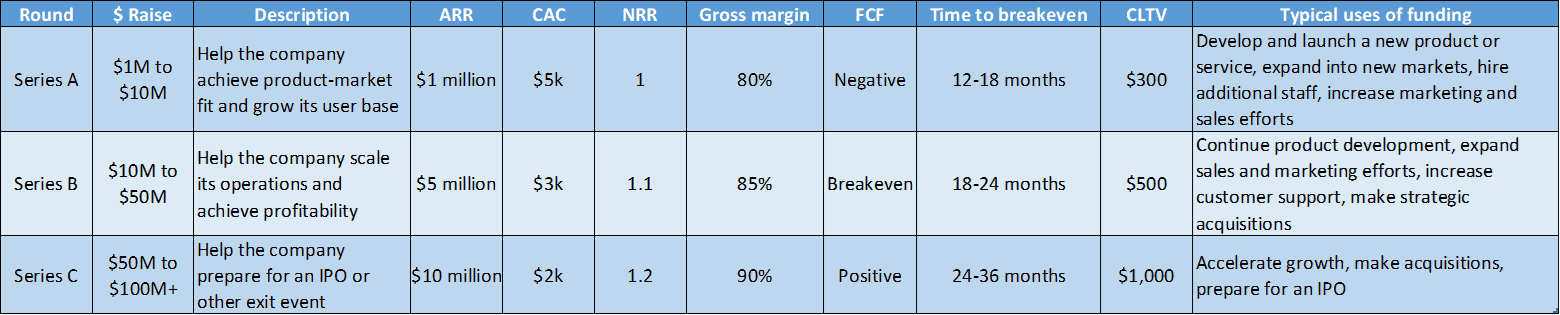

I’m not a fan of thinking (or worrying about) norms for various equity funding rounds. Just focus on the business — what funding is needed to get to the next milestones. However, much of the non-early stage VC community is driven by number counters. And founders would like some rough guidance for planning ahead and understanding VC expectations, so here are some general guideline benchmarks by funding round A-C for 2023.

It is important to note that these are just benchmarks and the actual requirements may vary depending on the specific company and its industry. However, these benchmarks can give SaaS CEOs a good starting point for assessing their company’s performance and identifying areas where they can improve.

Here are some additional things to keep in mind when interpreting these benchmarks:

- The benchmarks are based on data from top SaaS companies. These companies may have a different business model or target market than your company, so their benchmarks may not be directly applicable to you.

- The benchmarks are averages. There will always be companies that perform better or worse than the average.

- The benchmarks are constantly changing. As the SaaS industry evolves, so do the benchmarks.

It is important to track your own company’s performance over time and compare it to your own benchmarks. This will help you see how your company is doing and identify areas where you can improve.

- Annual recurring revenue (ARR): This is the total amount of revenue that a company expects to receive on a recurring basis over the course of a year.

- Customer acquisition cost (CAC): This is the cost of acquiring a new customer. VCs want to see that CAC is declining over time, as this indicates that the company is becoming more efficient at acquiring new customers.

- Net retention rate (NRR): This is the percentage of customers that renew their subscription each year. A high NRR indicates that customers are satisfied with the company’s product or service and are likely to continue using it in the future.

- Gross margin: This is the percentage of revenue that a company retains after paying for its costs of goods sold. A high gross margin indicates that the company is profitable and has a healthy business model.

- Free cash flow (FCF): This is the amount of cash that a company has left after paying its operating expenses and capital expenditures. VCs want to see that FCF is positive, as this indicates that the company is generating enough cash to fund its own growth.

Sources:

- SaaS Capital: 2023 SaaS Retention Benchmarks for Private B2B Companies: https://www.saas-capital.com/research/saas-retention-benchmarks-for-private-b2b-companies/

- Capchase Unveils its 2023 SaaS Benchmark Report Revealing How Revenue Leaders Can Drive Efficiency: https://www.prnewswire.com/news-releases/capchase-unveils-its-2023-saas-benchmark-report-revealing-how-revenue-leaders-can-drive-efficiency-301881415.html

- As growth becomes more elusive, a new set of software product benchmarks emerges: https://techcrunch.com/2023/07/18/software-product-benchmarks-2023

- Top 5 SaaS Metrics VCs Look At for Series A/B/C: https://medium.com/signalfire-fund/top-5-metrics-vcs-look-at-for-series-a-b-c-c6a0171fd200

Leave A Comment