The latest PitchBook-NVCA Venture Monitor report reveals an evolving venture landscape that demands adaptability from tech startup founders seeking funding. By examining key data and trends, founders can make smart decisions amid shifting market dynamics.

Tightening Purse Strings

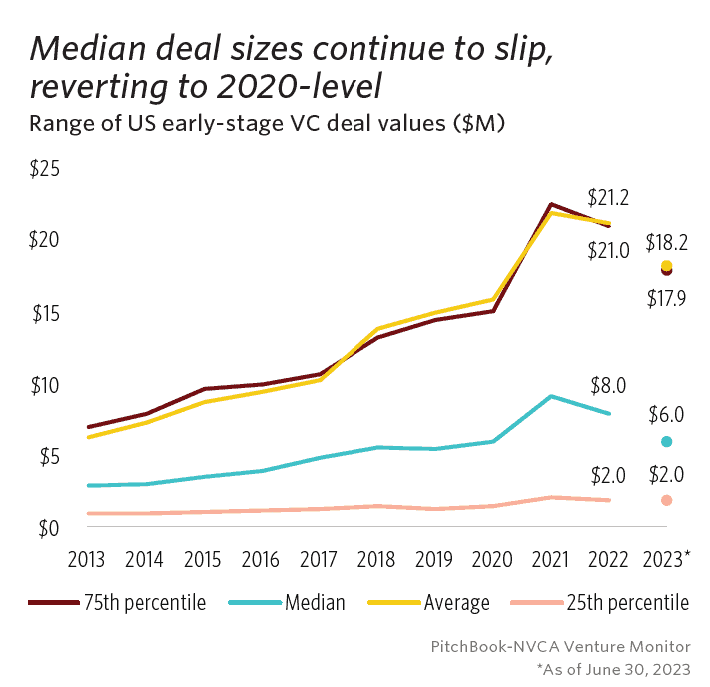

One major trend shows investors getting more selective with funding at all stages. As this chart illustrates, median early-stage deal sizes have declined 25% year-over-year to $6 million.

This means founders need to show investors concrete progress in product-market fit and traction to secure rounds. The report also finds seed deal activity slowing—prepare for longer closes and increased due diligence.

Runway Focus

With capital tighter, the report finds VCs advising startups to cut costs and extend runway to avoid raising in current climate. Areas like marketing and advertising prime for trimming.

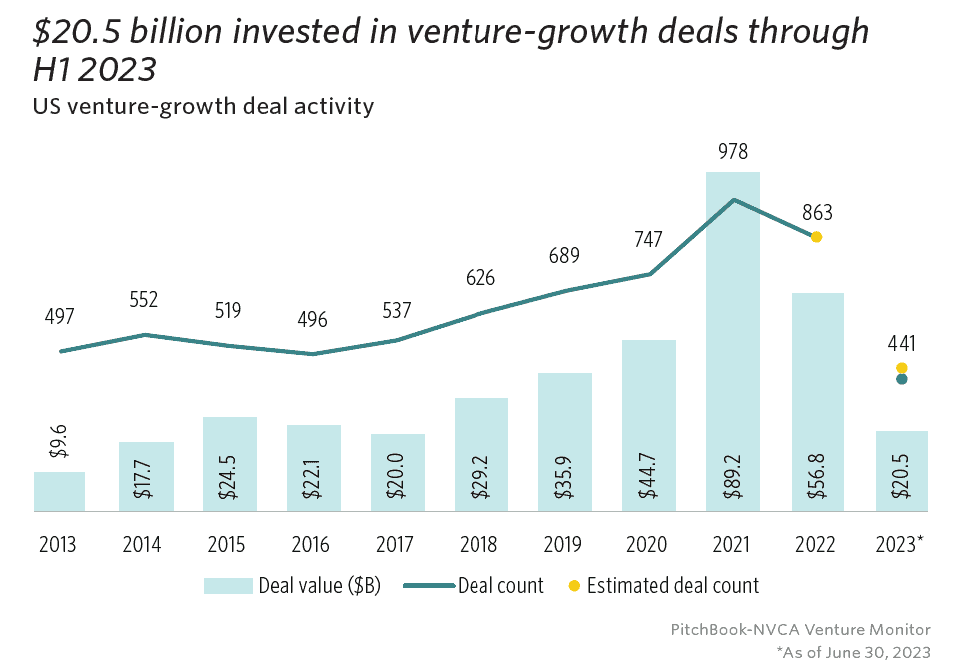

Raising too early risks lower valuations and harsher terms. Be ready to justify need for new capital and have clear path to next milestone. This prudent strategy also applies to growth-stage founders—as this chart shows, mega-rounds sharply declining.

M&A Uptick

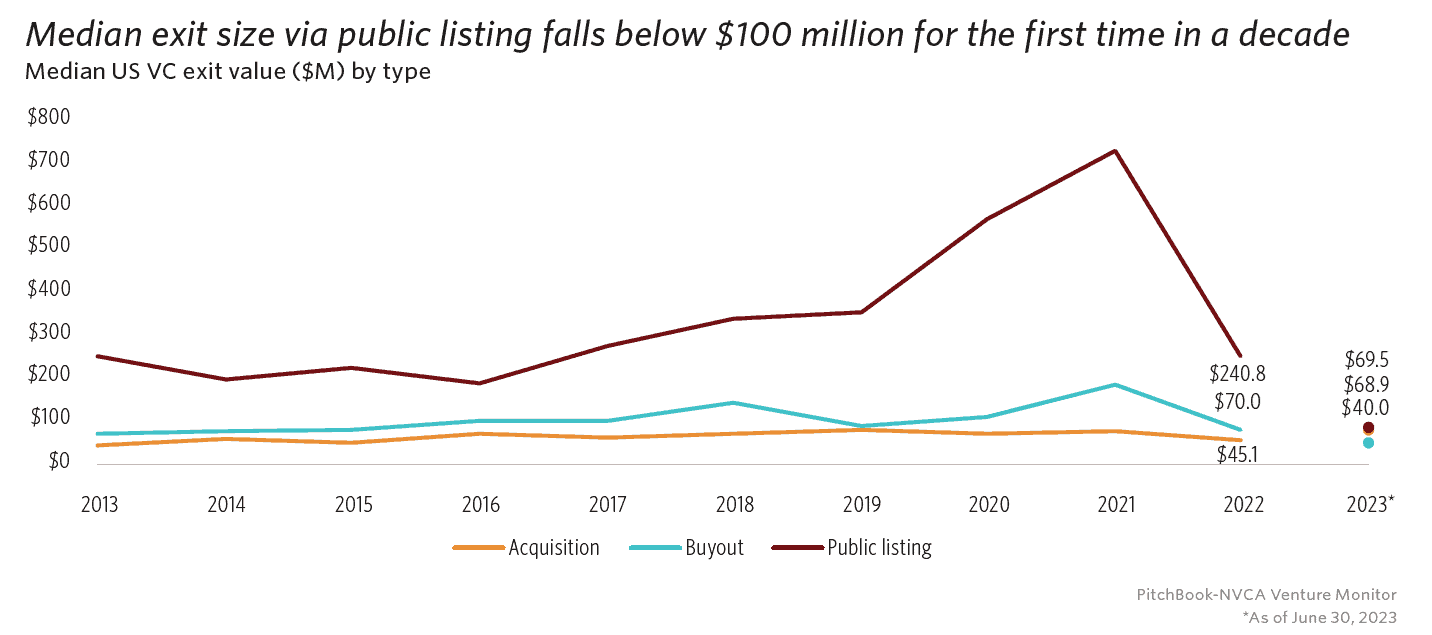

It’s not all gloom—the report finds a major uptick in VC exits via M&A. Corporates are acquiring startups that can’t reach the public markets.

This exit avenue looks to increase. Startups that can show business fundamentals and path to profitability may find promising acquisition opportunities.

Key Takeaways

While the funding environment is undeniably more risk-averse, data-savvy founders can adapt. PitchBook’s analysis provides intelligence to optimize decisions, conserve capital, impress cautious investors, and plan the right exit moves.

Leave A Comment